About FRRB

FINANCIAL REPORTING REVIEW BOARD- ICAI

Financial Reporting Review Board (FRRB) constituted in July 2002, is an important wing of ICAI that works to bring improvements in financial reporting practices and thereby promote investors’ confidence in audited financial statements.

COMPOSITION AND INDEPENDENCE OF THE BOARD

The Board comprises of members of the Central Council of the ICAI including Government of India nominee with representations from the office of the Securities and Exchange Board of India (SEBI), Comptroller and Auditor General of India (C&AG), Insurance Regulatory and Development Authority (IRDA), Central Board of Direct Taxes (CBDT) from time to time. The Council always endeavours to provide independence to the Board and keep it separate from the disciplinary mechanism of the Institute. FRRB neither has co-opted members or ex officio members including the President and Vice-president of the ICAI nor has any member of Disciplinary Committee on the Board. The members with significant expertise in the field work under confidentiality covenants.

FUNCTIONS OF BOARD

FRRB reviews the general purpose financial statements of enterprises and auditor’s report thereon with a view to determine, to the extent possible:

- Compliance with the generally accepted accounting principles in the preparation and presentation of financial statements;

- Compliance with the disclosure requirements prescribed by regulatory bodies, statutes and rules and regulations relevant to the enterprise; and

- Compliance with the reporting obligations of the auditor.

The Board restricts its reviews to the published financial statements only and do not carry out re-audit or review how audit has been conducted by auditors concerned. The Board doesn’t carry out a detailed scrutiny. Further, the review conducted by the Board is neither a judicial proceeding nor the quasi-judicial proceeding.

REVIEW PROCESS AND ACTION TAKEN BY THE BOARD

Selection of enterprises for review

The Board reviews the general purpose financial statements of various enterprises and the auditor’s report thereon selected on following basis:

Suo motto

- For suo motto reviews, the enterprises are short-listed on the basis of the criteria decided by the Board, from time to time, using a database available from a nationally renowned source (by random sampling method). After short-listing the enterprises based on the criteria decided by the Board, the required numbers of enterprises are selected using scientific methods such as random sampling.

Special Cases

- Reference by regulatory body like, Ministry of Corporate Affairs (Regulator of Corporate Affairs in India), Securities and Exchange Board of India (Regulator for the securities market in India), Insurance Regulatory and Development Authority (Authority for Insurance Sector Regulation and Development), Reserve Bank of India (India’s Central Banking Institution), Election Commission of India (Regulator of political parties) etc.

- Cases where serious accounting irregularities in the financial statements are reported in media.

REVIEW PROCESS

Three tier review mechanism is used by the Board for conducting the review process, i.e.

Stage 1: Preliminary review by an independent Technical Reviewer.

Stage 2: Review of Preliminary Review Report of Technical Reviewer by Financial Reporting Review Group (FRRGs).

Stage 3: Finally, review of Financial Reporting Review Group’s report along with Preliminary review report of a Technical Reviewer by the Financial Reporting Review Board (FRRB).

EMPANELMENT AS TECHNICAL REVIEWER

The criterion for selection of members to be empanelled as Technical Reviewers is decided by the Board time to time. At present, distinguished members of the profession may empanel themselves as a Technical Reviewer with FRRB who:

- Possess minimum five years’ experience of audit and who are either currently active in the practice of accounting and auditing or are in Industry having comparable experience in the fields of Accounting and Auditing; and

- Qualified the Certificate Course on Ind-AS; and

- Having exposure in preparation and finalisation or audit of Ind-AS based Financial Statements

Appropriate honorarium and CPE hours are also provided to Technical Reviewers for their services. Further, time to time, training programmes for technical reviewers are also conducted across the country to guide them on further enhancing their review skills of the General Purpose Financial Statements and to acquaint them with major non-compliances observed by the Board. To empanel as Technical Reviewer click here

FINANCIAL REPORTING REVIEW GROUPS (FRRGs)

The preliminary review reports of TR are considered by the FRRG consisting of 4-5 members. The Chairman of the Board is authorised to constitute one or more Financial Reporting Review Groups to conduct the review of the cases in consultation with the Board. The Review Group may utilize the services of an expert, who possess at least ten years of experience in practice or in service, for preparing Group reports. The honorarium to be paid to such expert as well as members of FRRGs may be decided by the Board and approved by the appropriate authority of the Institute.

ACTIONS TAKEN BY FRRB BASED ON REVIEW

The Board may take any of the following actions based of the review of the financial statement with respect to:

AUDITORS:

- In case of material non-compliance, which affect the true & fair view of the financial statements, such cases are referred to the Director (Discipline) of the ICAI for initiating appropriate action against the auditor.

- If the non-compliance is not of a material nature, the Board issues advisory to the auditor to help/guide auditors towards best practices & transparency in reporting of financial statements.

MANAGEMENT OF THE ENTERPRISES:

Informs irregularity to the regulatory body Ministry of Corporate Affairs (MCA), Reserve Bank of India (RBI), Securities and Exchange Board of India (SEBI), Insurance Regulatory and Development Authority (IRDA), Election Commission of India (ECI) etc. relevant to the enterprise for appropriate action.

PARTNER IN NATION BUILDING- SUPPORTING REGULATORS

As a part of achieving public interest and overall ICAI ethos of being partner in nation building, FRRB supports government and other regulatory bodies. In case FRRB finds any material or significant non-compliance affecting true and fair view of the financial statements (selected as suo motto or as special case), it refers the case to concerned regulators, i.e., MCA, RBI, IRDA, CAG, Director (Discipline) ICAI.

Thus, it is acting as an agency for all concerned regulators that endeavour to improve transparency in financial reporting. ICAI’s alliance with regulators like MCA, ECI, C&AG, IRDA would continue to be instrumental in improving the financial reporting practices in India. Considering it as an effective mechanism, various regulators (viz. MCA, SEBI, C&AG, ECI) refer financial statements for review to FRRB.

CREATING AWARENESS AMONG THE MEMBERS

Publications

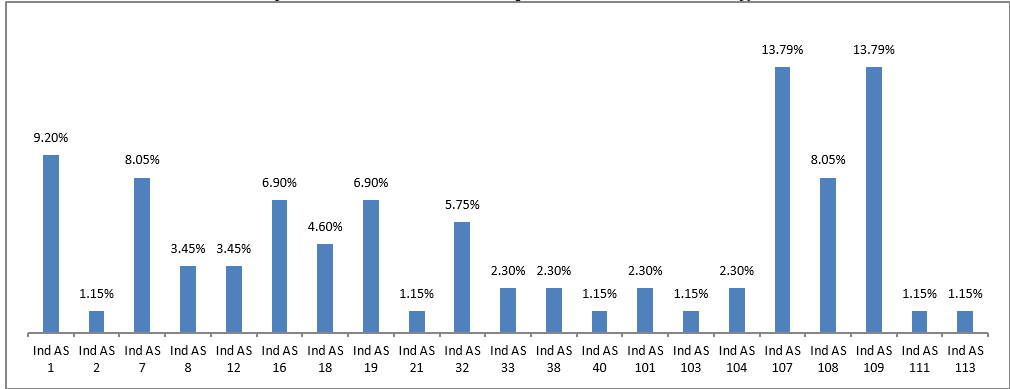

Detailed observations are available in “Study on Compliance of Financial Reporting Requirements (Ind AS Framework)“

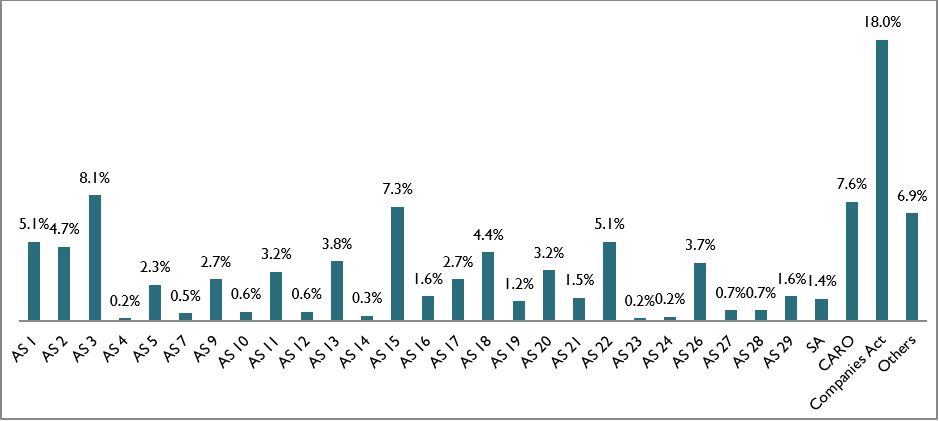

Detailed observations are available in “Study on Compliance of Financial Reporting Requirements, Volume III”

Articles in Journal

With a view to apprise the members of the Institute and others concerned about the non-compliances observed during the review, note on non- compliances are published in the Institute’s Journal, ‘The Chartered Accountant’ from time to time. To access articles click here

Programmes

In its endevour to improve financial reporting practices in the country, from the year 2007, FRRB initiated to organize Awareness Programmes on Financial Reporting Practices, updating the knowledge of the preparers of the financial statements and auditors with the amendments taking place in financial reporting framework and also to apprise them about the common non-compliances observed by the Board during review of various financial statements. Such programs are well appreciated by the members of the Institute which is reflected from the overwhelming participation of members in various Awareness programme.